Let’s face it: in terms of health insurance software landscape, the current years are exactly where the tables turn, like it or not. Developments that were previously hidden as a know-how by few corporate players are hitting the market and becoming a must-do for everyone else. In this article, we’re researching the most prominent features of health insurance software based on our own cases and projects to create a sort of a concise guide for business stakeholders.

Health insurance software landscape in 2024-2025

People are now more concentrated on their health and “financial health” alike. Judging from what the statistics from the National Health Expenditure Accounts (NHEA) have to say, the average person is going to keep spending more and more on healthcare (not that it’s that bad, actually!), with the overall spending reaching upwards of 19% of the GDP by 2024. Before we say it’s due to millennials and GenZ making awareness a trend, no – just not yet: the current factors are largely the aging population, chronic diseases, and the rising costs of healthcare tech and pharmaceuticals. Accordingly, insurers are pressed to find solutions that balance cost efficiency with patient centricity to stay competitive.

Unsurprisingly, the market has seen a surge in the adoption of what we now call value-based care models. For instance, a report by the Centers for Medicare & Medicaid Services (CMS) highlighted that over 40% of Medicare payments in 2024 were through alternative payment models that focus on quality and value over volume. What these models do is, they emphasize a coordinated approach to healthcare, where providers are incentivized to work together to improve patient outcomes while controlling costs.

What’s actually surprising is the increasing reliance on technology to streamline healthcare services – and as a sidenote, telemedicine is growing, too (although with COVID, who couldn’t have seen it coming?). A survey conducted by the American Telemedicine Association projected that by 2025, 50% of all medical consultations could be performed via telehealth platforms, a significant increase from just a few years prior. The adoption of telemedicine is also helping the health insurance industry introduce new billing and coverage policies, which aim to make these digital services as accessible and as financially sustainable as in-person visits.

What problems can insurance software development actually solve?

But what can custom medical insurance software actually do for a company and for an individual consumer? It turns out, quite a lot:

Facilitating work on documentation: Healthcare insurance software significantly streamlines the documentation process, making it easier, faster, and more accurate. The key lies with some of the more advanced data management technologies: insurers can now seamlessly manage claims, policies, and patient records faster… and (paradoxically) in a more humane way, since being relieved of mechanical tasks will push the job market in the industry toward those who can empathize competitively. For patients and providers, this means simplified claims processing and faster reimbursements, improving the overall experience.

Process automation: By automating routine tasks, such as claims processing and policy management, a lot can be achieved (see above) – but the focus here should be on the more complex, AI-driven processes like fraud detection, automation increases efficiency and reduces operational costs. For insurers, this means being able to handle a higher volume of claims with greater accuracy and less manpower, thus speeding up response times and improving customer service.

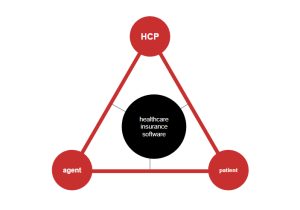

Communication: At the end of the day, there are just three parties involved: insurance agents/companies, HCPs, and patients/payers/caregivers, and they have equal importance – i.e. if you force people to comply with your own constraints, you’re doomed in the competition race. Software providers and business leaders have admitted this about a decade ago en masse, so today there are secure messaging platforms and integrated communication systems, through which information can be exchanged in real-time, ensuring all parties are kept in the loop. This fosters a more collaborative environment and helps in making more informed healthcare decisions.

Data Analytics and personalization: By now, data processing has become an industry of its own, and health insurance billing software is also gaining a competitive edge by utilizing AI/ML-powered tech. The insights that go into the pot are very different: consumer behavior data, market trends, and past evidence-based decisions (that can be further analyzed much like the ancient Chinese divinations, but in a modernized data-based way). Meanwhile, personalization algorithms allow for tailored insurance plans that meet individual needs, enhancing customer satisfaction and engagement.

Compliance and security hurdles: Healthcare insurance software is, by necessity, designed with robust security measures and compliance tools that automatically update to meet the latest regulatory standards. This not only protects against data breaches but also ensures insurers are always in compliance, avoiding costly fines and reputational damage.

Member engagement: Finally, healthcare insurance software plays a crucial role in promoting member engagement and wellness programs. Through mobile apps and online platforms, insurers can encourage healthy behaviors, track progress, and offer incentives for maintaining a healthy lifestyle. This not only benefits the policyholders’ health but also reduces healthcare costs by preventing diseases and complications.

But just how well does this software approach perform?

Benefits of insurance software development services

Potentially, software development services can be transforming the industry by enhancing operational efficiencies, improving customer interactions, and ensuring compliance with evolving regulations. Here’s a breakdown of the key benefits:

- Enhanced Efficiency and Productivity: Automation of routine tasks reduces manual labor and the potential for human error. Meanwhile, streamlined workflows allow for faster processing of claims and underwriting.

- Improved Customer Service: Client portals and mobile applications provide customers with easy access to their policy details, claims status, and direct communication tools. Faster response times and proactive services increase customer satisfaction and loyalty.

- Advanced Data Analysis: Sophisticated analytics tools help understand risks better and tailor products to meet customer needs. Predictive analytics can identify potential fraud and prevent losses.

- Regulatory Compliance: Ensures that all operations are up-to-date with current laws and regulations in real time. Reduces the risk of penalties and legal issues connected with non-compliance.

- Cost Reduction: By automating processes and reducing manual intervention, companies can significantly lower operational costs. Enhanced risk assessment helps in setting premiums more accurately, potentially reducing claims expenses.

- Enhanced Security: Strong cybersecurity measures protect sensitive customer data from breaches and theft. Continuous updates and maintenance further secure the software against emerging threats.

- Personalization and Product Innovation: Ability to offer customized insurance products tailored to individual needs. Quick adaptation to market changes and consumer demands for innovative product offerings.

- Better Decision Making: Real-time data and reports aid in making informed decisions that align with business objectives and market conditions. Insights from data can guide strategic planning and operational adjustments. Increased Scalability: Agile software solutions can grow and adapt as a business expands or needs change. Enables entry into new markets with tailored products and services. Insurance software development services thus not only streamline existing processes but also offer far-reaching implications for innovation and growth within the insurance industry.

Top 8 features requested in health insurance software development

#1 Choice of plans and policy comparison

At its core, this feature integrates sophisticated filtering and sorting capabilities, allowing users to easily narrow down their options based on various parameters such as coverage amount, premium cost, policy tenure, network hospitals, and more. This functionality is supported by a dynamic and responsive user interface that visually represents differences between plans with comparative tables and charts, making it straightforward for users to assess and contrast the value proposition of each plan against their unique requirements. Additionally, tooltips and informational pop-ups are integrated to clarify insurance terminologies, ensuring users fully understand the plan benefits and terms they are comparing.

#2 Policy purchases and underwriting

What sets this feature apart is its ability to offer immediate policy decisions in many cases, thus enhancing the customer experience by providing clarity and rapid service. For insurance providers, this automation translates to increased efficiency, reduced operational costs, and minimized risk of human error. Additionally, the software facilitates seamless communication channels within its platform, allowing applicants to track their application status, ask questions, and receive notifications about their policy approval or any further requirements needed to complete the underwriting process.

#3 In-app payments

This way of digitizing things around the industry involves letting the patient (who doesn’t really care about anyone’s business model) to conveniently pay premiums, view transaction histories, and manage their financial obligations related to their insurance policies. In practice, this translates to creating as many payment gateways and methods as possible/reasonable: credit/debit cards, ACH bank transfers, and mobile wallets. SOf course, security is paramount; therefore, the in-app payment system adheres to strict protocols for encryption and complies with regulatory standards such as PCI DSS to safeguard sensitive financial information. Other popular functionalities that fall under this category include automated payment reminders, the ability to set up recurring payments for policy renewals, and instantaneous payment acknowledgments, enhancing user experience with practical financial management tools. This is not just beneficial for policyholders (who, as a rule, don’t like dedicating too much time to minutiae) but also reduces administrative overhead for insurers, leading to a more efficient and user-oriented service approach.

#4 Finding HCPs

Many people just like having “their own” HCPs whom they trust. Most don’t, but would like to, and that’s where an insurance provider can fill in the “trusted” role. In terms of patient-facing software, this means incorporating advanced search filters, where users can look up HCPs based on specialty, location, provider ratings, available appointment times, and whether the provider is accepting new patients. Geomapping is involved here, too.

Moreover, the detailed profiles for healthcare providers can be made to include essential information such as qualifications, languages spoken, services offered, and direct links for making appointments. In addition to enhancing user experience, this feature aids in streamlining the healthcare process by ensuring members can access the right type of care when they need it, effectively managing their health outcomes.

#5 HCP to patient communication

Within the context of healthcare insurance software, the feature facilitating communication between healthcare providers (HCPs) and patients serves as a pivotal element in enhancing healthcare delivery and patient satisfaction. This feature is meticulously designed to enable secure and efficient exchanges, such as appointment scheduling, medical consultations, and follow-up communications directly within the platform. Utilizing secure messaging interfaces and video conferencing tools, it provides a convenient and confidential channel for patients to discuss their health concerns, receive medical advice, and engage in telehealth appointments with their chosen HCPs without leaving their homes.

The integration of this communication feature also supports the seamless sharing of electronic health records (EHRs), lab results, and prescription information between patients and providers, ensuring that both parties have access to the necessary data for informed health management decisions. This direct line of communication fosters a stronger patient-provider relationship, encouraging proactive health management, improving adherence to treatment plans, and facilitating timely intervention when necessary. For healthcare insurance providers, offering this capability within their software not only aligns with the increasing demand for digital health solutions but also contributes to higher policyholder satisfaction and retention rates by providing a comprehensive and accessible healthcare experience.

#6 Document management

Document management within healthcare insurance software is a critical feature that significantly contributes to the efficiency and organization of the insurance process for both policyholders and insurance administrators. This feature addresses the extensive need for storing, managing, and securely sharing a wide range of documents, including policy documents, claim forms, medical records, and compliance documentation.

Here are some key aspects:

- Digital Storage and Organization

- Security and Compliance

- Version Control and Audit Trails

- Collaboration and Sharing

- Integration with Other Features

- Mobile Access and Cloud-Based Solutions

By streamlining the document handling process, improving accessibility, and ensuring data integrity and security, the document management feature within healthcare insurance software plays a crucial role in enhancing operational efficiency, supporting regulatory compliance, and ultimately improving the user experience for both providers and policyholders.

#7 Claim management

Claim management is a cornerstone feature of healthcare insurance software, streamlining the entire process from claim submission to settlement. It automates numerous aspects of claim handling, enhancing accuracy and reducing manual intervention, which, in turn, speeds up claim processing times and improves both insurer and policyholder satisfaction. A seamless interface allows healthcare providers and policyholders to easily submit claims online, complete with all necessary documentation attached via the integrated document management system. This digitized submission process helps reduce errors and ensures that all relevant information is collected upfront, facilitating quicker assessments.

Additionally, the claim management system includes robust workflows designed to automatically verify claims against policy terms, flag discrepancies, and identify potential fraud, leading to more accurate adjudication and compliance with regulations. Advanced analytics tools within the software further enable insurers to monitor claims over time to identify patterns, assess risks, and refine policy guidelines accordingly. For policyholders, the feature includes real-time tracking of claim status and direct communication channels with claim handlers, making the often stressful process more transparent and less cumbersome. Overall, effective claim management within healthcare insurance software not only operational efficiencies but also contributes to better financial management and enriched customer relationships.

#8 Push notifications and reminders

Push notifications and reminders are a highly valuable feature within healthcare insurance software, serving as a direct channel for engaging with policyholders and ensuring timely actions and communications. This feature enables insurance companies to send personalized alerts and reminders related to policy renewals, upcoming appointments, preventive health check-ups, and claim status updates directly to a user’s mobile device or email. By providing these timely notifications, the software plays a crucial role in enhancing user experience, encouraging proactive healthcare management, and ensuring that policyholders remain informed about important deadlines and benefits utilization. Moreover, this targeted communication method can significantly increase policyholder satisfaction and engagement by keeping users connected and informed, reducing the likelihood of missed renewals or benefits, and fostering a sense of support and care from their insurance provider.

Where to focus? Types of insurance billing software (and adjacent solutions)

Creating a health insurance software product is arguably better in the long run than buying an out-of the box solution, simply because your organization will likely have different needs than everyone else due to the existing business model. While white-label software usually doesn’t actually focus on everything, while trying to please everyone, with a custom platform, you can define what features to have and which are not worth investing into. That being said, there still are several types of solutions that kind of “magnetize” features-to-implement onto them depending on what they’re focused on, and what’s easiest to implement once you have them. Let’s explore each type in turn:

Claim-Centric Solutions: Streamlining the Claims Process

Focus Area: Efficiency, Accuracy, and Fraud Detection

Claim-centric solutions are initially meant to expedite and simplify the claim lifecycle all the way from submission to settlement. The “obligatory stuff” here usually includes something to automate claim handling, the incorporation of fraud detection algorithms, and the assurance of regulatory compliance. Machine learning is involved too: with the right algorithms, the software can predict and flag potentially fraudulent claims, while rule-based engines ensure that claims adhere to policy stipulations. This not only enhances processing speed but also maintains accuracy and trustworthiness, crucial for both insurer and insured.

Agent and Policy Management Solutions: Empowering Insurance Agents

Focus Area: Agent Productivity, Policyholder Experience, and Sales Growth

Agent and policy management solutions are slightly different: they are implemented by those organizations where the majority of challenges is on their own side. Hence, the focus here is rather on developing intuitive interfaces for agents to manage policies, onboard new customers, and track renewals and claims with ease. Integrating CRM tools alongside policy management systems also makes it easier for agents to achieve personalized approaches. Finally, these platforms will typically offer real-time insights and analytics that empower agents to make informed decisions.

Patient-Centric Solutions: Prioritizing Patient Engagement and Care

Focus Area: Accessibility, Health Management, and Communication

Patient-centric solutions aim to place the patient’s needs and experience at the forefront of health insurance. A strong emphasis on providing mobile and online access, secure communication channels between patients and healthcare providers, and tools for managing healthcare appointments and treatments are essential. Incorporating features like telehealth services, medication adherence reminders, and health tracking enriches patient engagement and encourages active participation in health management. Such solutions should facilitate a seamless flow of information, enabling patients to make informed choices and manage their health proactively with full support from their insurance provider.

Conclusion

As we’ve established, it’s best to have a custom solution of your own, tailor-made to address the unique demands of its intended users. Be it through streamlining claims, equipping agents with powerful tools, analyzing data for better decision-making, or putting patients at the heart of it all – the goal is to construct a health insurance platform that not only solves problems but also paves the way for a more efficient, data-driven, and patient-focused future in healthcare insurance. You can address our experts to discuss your project right away.